PayPal vs Stripe for WooCommerce: Which One Should You Use

Whether you are running an eCommerce website store or looking to create eCommerce store with WordPress WooCommerce Specialists in Sydney or just selling your services via the internet, in both cases you would need a payment gateway to handle your cash flow.

When it comes to selecting a payment gateway, people are confused about which one to choose for their business. The two most commonly used payment gateways are PayPal and Stripe.

In this article, we will discuss the two and see how each one can help you in managing your transactions.

Table of Contents

- Why Use PayPal?

- Advantages of PayPal for WooCommerce

- Why Not to Use PayPal?

- Why Use Stripe?

- Advantages of Using Stripe

- Why Not to Use Stripe?

- Verdict: What to Use? PayPal vs StripeBoth.

Why Use PayPal?

PayPal is known for its reputation globally. It is one of the most used payment gateways available online. Since PayPal allows transactions directly to PayPal from credit cards, it is used by drop shippers and e-commerce stores across the West. Store owners mostly use PayPal because it offers better support and security of funds.

Looking to build you first online store? We are Sydney’s most trusted eCommerce Website Developers.

Advantages of PayPal for WooCommerce

Here are some advantages of using PayPal for your WooCommerce store.

– Easy Integration with WooCommerce

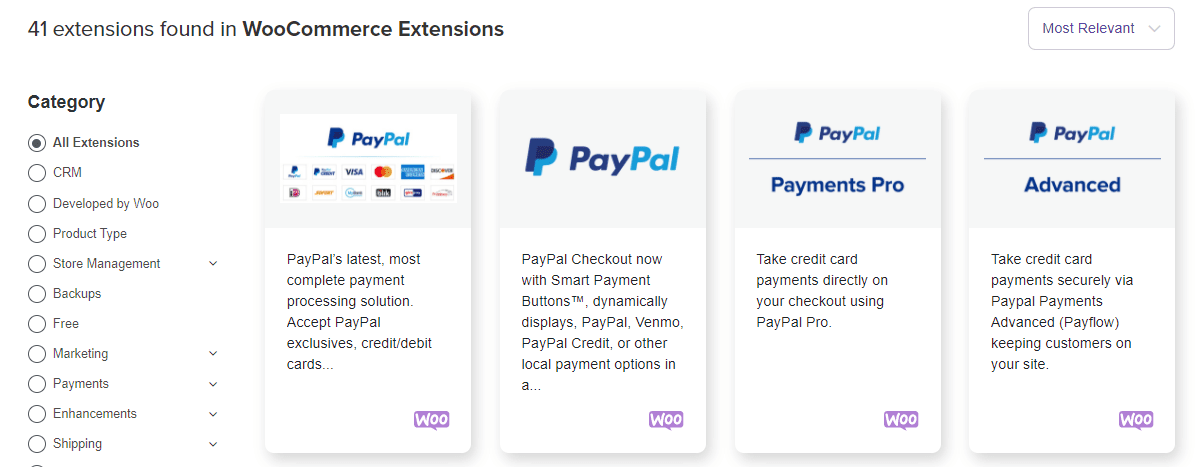

One of the biggest advantages of PayPal is that it can be directly integrated with WooCommerce. PayPal can be integrated using the Easy Digital Downloads plugin or PayPal checkout extension from the WooCommerce plugin menu.

Simply visit the WooCommerce plugin link to get your desired plugins and add them to your store. That is it.

Once the plugin is installed, you just need to verify it through PayPal and you are now ready to start receiving payments through the PayPal payment gateway.

Note: If you don’t have a PayPal business account, you will need to first create one before starting transactions on your eCommerce store.

– Easy Pricing for Beginners

PayPal is as easy as it can get. Simple transaction fees of 2.9% + 0.33 tax on credit card transactions for online stores is all Paypal will charge. There are no hidden charges because all transactions follow the same rule. That’s why people love PayPal because they can easily adjust the transaction charges within the price of the product that they are selling.

On the other hand, PayPal is also loved by buyers because of its trust and reliability. They can easily enter disputes and win cases if they don’t get products that they asked for.

– Faster Payout

Another advantage of using PayPal is the payout option it offers to the users. Sellers can create flows for running their eCommerce stores. Once a transaction is made, the proceeds can directly end up in their bank. So, in a sense, they don’t have to rely on PayPal to send the payment to their band at the end of the monthly payment cycle.

– Faster Transactions

PayPal only requires your email address and a 2FA authentication. That is it. Nothing can beat this much flexibility. The transactions happen within seconds. Users can simply pay for the product directly from their PayPal or credit card and that is it.

– Accepted Worldwide

As we had already discussed earlier, PayPal is one of the widely used eCommerce payment gateway used online. It is fast, simple to use, and has a global outreach. Therefore, it is accepted worldwide. In short, PayPal is known for its high quality, better transaction rate, and flawless support during disputes and financial issues.

– Easy to Configure

PayPal doesn’t require any complex configuration. Simply create a PayPal business account and integrate it with your WooCommerce store. That is it. You are now ready to receive payments from buyers directly to your WooCommerce store.

Why Not to Use PayPal?

Although PayPal is great but it also has its fair share of issues. Let’s learn a little about that.

– Frozen Accounts

PayPal is brutal when it comes to freezing accounts and blocking user transactions. Even if you have funds in your account and PayPal observes that you are not residing in the US or your personal information is forged, it will freeze your account.

– Extra Service Charges

PayPal often charges extra service charges depending on certain scenarios. Although these are explicit but they are still ‘extra’ charges.

– No Seller Protection

As said about frozen accounts, there is no seller protection on PayPal accounts. So, you are only on your own when it comes to PayPal account management. That’s why people prefer to transfer funds directly to their bank accounts as soon as they receive them.

Need to Customise PayPal for WooCommerce? Contact Us Today

Why Use Stripe?

Stripe is a great payment gateway and a worthy alternative to PayPal when it comes to WooCommerce stores. It is also a global payment gateway and used widely in Europe and Asia for transactions.

Advantages of Using Stripe

Here are some of the advantages of using a Stripe payment gateway for your eCommerce store.

– Additional products and services

Stripe offers multiple other products and services aside from the transactions such as subscriptions, trials and coupons, marketplace options, and a lot more. So, in a sense, it is great for users who have small eCommerce stores and want to increase their reach to wider markets.

– Quick WooCommerce integration

Just like PayPal, Stripe can also be directly integrated with WooCommerce stores without any issue. You just have to sign-in and permit the store to use the account for transactions. Once that is done, your Stripe account will be automatically integrated.

– One Flat Fee

Stripe offers a one-time flat fee for users who want to get payments through this payment gateway. The tax deductions are made at the sellers’ end. The transaction fee is 2.9% + 30 cents for all orders if the consecutive volume is below $1 million per year.

– Free Developer Tools

The Stripe payment gateway is customizable. So, instead of just getting a button as you get with PayPal, you can customize the Stripe script as per your liking. Developers can easily customize Stripe using the libraries available. This allows them to create their own extensions and plugins, or improve the current script as per their liking.

Why Not to Use Stripe?

Stripe is just like PayPal when it comes to disadvantages. Before you avail of this service, you must know about the nitty-gritty details.

– Frozen Accounts & Termination

Stripe can also freeze your account and terminate them if it finds that you are not following its terms and services. And when it comes to Stripe TOC, it is long and has multiple clauses for eCommerce store owners. Make sure you read it properly.

– Not User Friendly

Stripe is often hard to configure and that’s why developers love it. While it offers them flexibility in site management, it is not so beginner-friendly. So that is another drawback of Stripe. Doesn’t offer you the best of both worlds.

Need to Customise Stripe for WooCommerce? Get in Touch With Us

Verdict: What to Use? PayPal vs Stripe

Both.

Well, both tools have their pros and cons as we have seen above. When it comes to selecting a payment gateway, see what is best for your audience because in the end, it will be them who will be using it.

You can also test both the payment gateways and then settle with one that is working better for you.

If you are unsure how to add a payment gateway to your WooCommerce store, then get in touch with us.

Learn to create a simple WooCommerce WordPress site in 5 simple steps.